Introduction

Twenty years ago, the investment landscape looked vastly different, especially for technology stocks. Nvidia, a company primarily known for its graphics processing units (GPUs), was just beginning to make its mark. If you had the foresight to invest $10,000 in Nvidia two decades ago, you would have witnessed a remarkable journey of growth and transformation.

The Rise of Nvidia

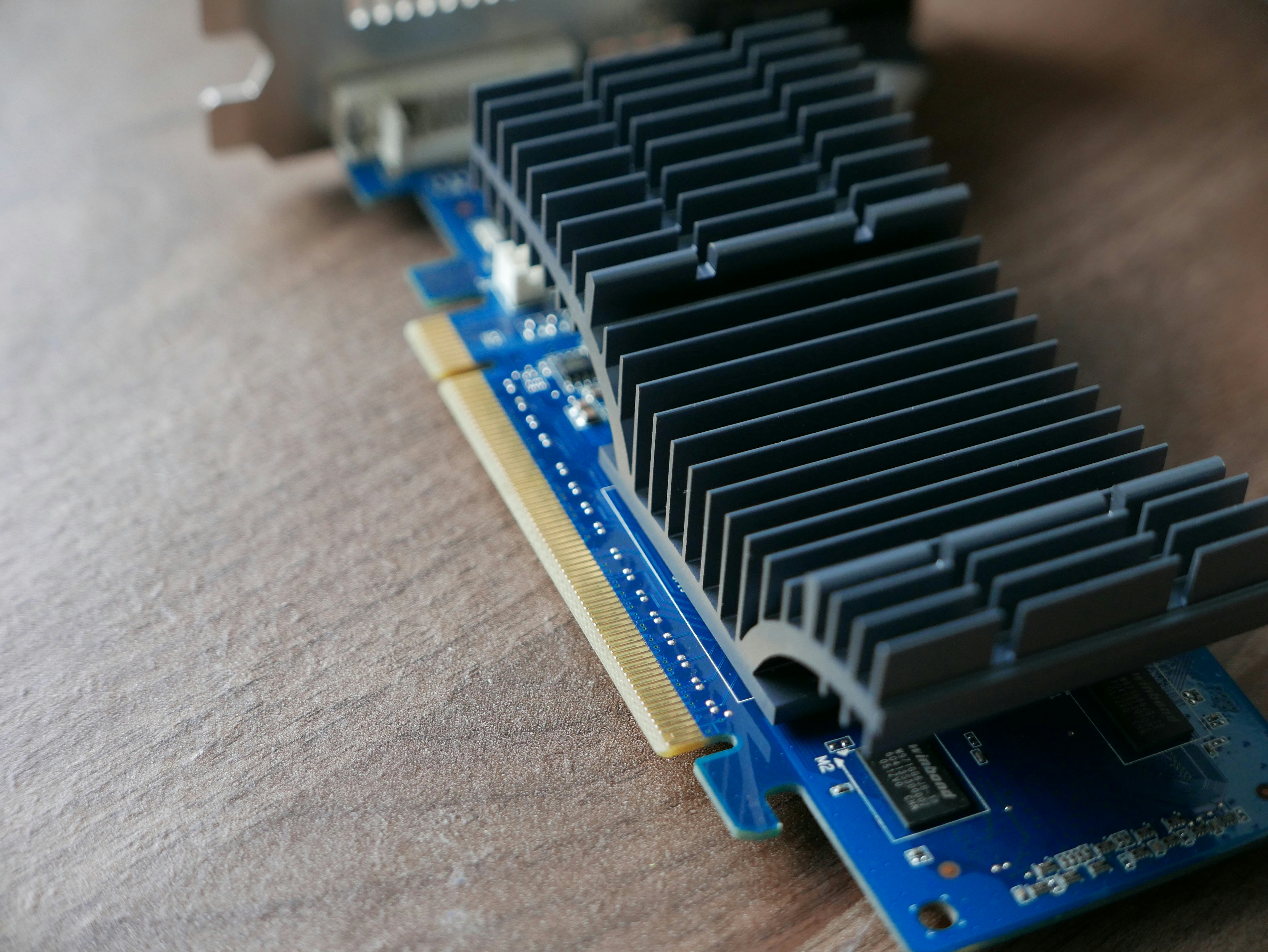

Nvidia’s evolution from a niche manufacturer to a leading technology powerhouse is a testament to its strategic innovations and market adaptability. Initially, the company focused on graphics cards for gaming. However, it later expanded its reach to artificial intelligence (AI), machine learning, and data center solutions, effectively broadening its revenue streams. This shift in focus has been pivotal in driving Nvidia’s stock price higher.

The Return on Investment

If you had invested $10,000 in Nvidia twenty years ago, you would have witnessed an astounding return on your investment. Over the years, as the demand for high-performance computing solutions surged, Nvidia’s stock soared exponentially. While investment values fluctuate and past performance cannot guarantee future results, those who believed in Nvidia’s vision have reaped significant financial rewards.

In summary, investing $10,000 in Nvidia two decades ago would have set you on a path to remarkable financial growth. The company’s strategic decisions and innovation have made it a formidable player in the tech industry, leading to impressive returns for its early investors.