What is a Stock Split?

A stock split is a corporate action in which a company divides its existing shares into multiple new shares to boost liquidity. This process results in a proportional reduction in the price per share while maintaining the overall market capitalization. For instance, in a 2-for-1 stock split, shareholders will receive an additional share for every share they own, effectively halving the share price. Thus, if the stock were previously valued at $100, it would then be priced at $50, without changing the total value of the investment.

There are two primary types of stock splits: forward splits and reverse splits. A forward split, as highlighted earlier, increases the total number of shares outstanding while reducing the share price. Conversely, a reverse split consolidates the shares, leading to a decrease in the total number of shares and an increase in the share price. Such actions often occur when a company’s stock price is perceived as too low. By consolidating shares, a reverse split may provide the impression of stability and attractiveness to investors.

The motivations behind a stock split can vary. Companies may initiate a forward split to make their stock more affordable and appealing to a broader range of investors. This approach can enhance liquidity and trading volume, which are advantageous for the overall market sentiment and can stimulate investor interest. On the other hand, a reverse split might be seen as a strategy to meet exchange listing standards or attract institutional investors by appearing to be a more significant, more reputable entity.

Additionally, price adjustments can influence investor psychology, often impacting market perception. Many investors perceive lower-priced stocks from forward splits as more accessible and potentially rewarding. Therefore, understanding the implications of stock splits, both logistically and psychologically, is crucial for investors looking into stocks like AVGO and their associated market movements.

Overview of AVGO and its Recent Performance

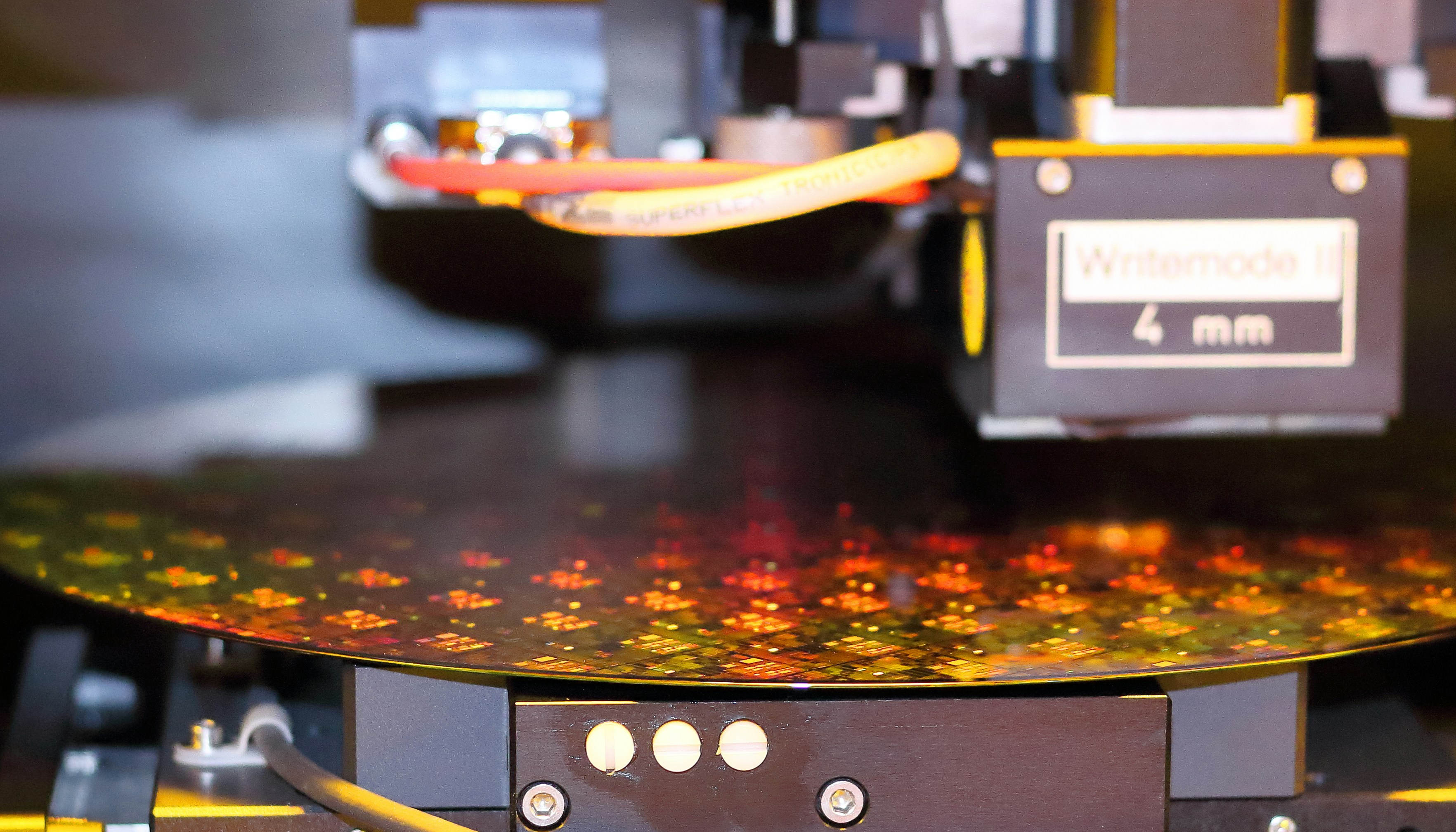

Broadcom Inc. (AVGO) is a leading global technology company that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions. Established in 1961, the company has significantly evolved, focusing on sectors such as wireless communications, enterprise storage, network infrastructure, and broadband. AVGO plays a crucial role in the technology ecosystem, powering innovations such as the Internet of Things (IoT), artificial intelligence, and data centers.

In recent years, Broadcom has experienced robust financial growth, reflecting its strong market position and diversification efforts. For the fiscal year ending October 2023, AVGO reported revenue growth of approximately 15% year-over-year, driven by increased demand for its products across various applications, including 5G networks and cloud infrastructure. The demand has played a significant role in AVGO’s ability to capture a larger market share, particularly in high-growth segments.

Stock performance trends have been promising, with AVGO shares demonstrating a notable upward trajectory. Over the past five years, the stock has more than doubled in value, underpinned by consistent earnings growth and strategic acquisitions that have expanded its product offerings and market reach. Additionally, the company’s focus on returning value to shareholders through dividends and share buybacks has further enhanced its attractiveness in the investment landscape.

Leading up to the stock split announcement, various factors influenced AVGO’s decision. Analysts noted that the sustained positive performance and increasing stock price may have necessitated a split to enhance liquidity and make shares more affordable to a broader base of investors. Moreover, the stock split aligns with traditional practices in the technology sector, aiming to democratize access to shares, thereby increasing institutional and retail investor participation.

Implications of the AVGO Stock Split for Investors

The recently announced AVGO stock split has generated considerable interest among current and prospective investors. Stock splits, such as the one involving AVGO, can have various implications that merit attention. One of the most immediate effects of a stock split is increased liquidity. By reducing the nominal price of each share, stocks become more accessible to a broader range of investors. This can lead to higher trading volumes and improved market activity, which is particularly important in the context of the semiconductor industry where AVGO operates.

Moreover, the perception of affordability plays a significant role in investor behavior. A lower share price post-split can create an illusion of value, enticing retail investors who may have previously hesitated due to the stock’s higher price. This demographic shift may bolster demand for AVGO shares, potentially driving prices upward. Additionally, stock splits can serve as a marketing tool to increase visibility and attract new investors, further enhancing market activity.

However, it is essential for investors to consider the opinions of market experts regarding the long-term benefits of stock splits. Some analysts argue that stock splits are primarily short-term tactics designed to artificially boost share prices without fundamentally altering a company’s market capitalization or financial standing. This viewpoint suggests that while the split can enhance liquidity and affordability, it does not inherently signify an increase in the company’s value or performance metrics. Therefore, understanding these nuances is critical for both current and potential investors in navigating their expectations for AVGO. While splits can stimulate interest, a long-term investment strategy should incorporate thorough analysis of the underlying business fundamentals rather than mere stock split events.

Conclusion: What’s Next for AVGO Stock Post-Split?

The recent stock split of AVGO, broadly resonating within the investment community, has opened a new chapter for the company. A stock split typically aims to make shares more accessible to a wider range of investors, which can potentially enhance liquidity and attract a broader base of shareholders. As we assess the situation in the aftermath of the split, it is essential to consider several factors that may influence AVGO’s performance moving forward.

Investors are likely to react positively to the stock split in the short term, as it often generates increased interest and trading activity around the stock. The perception of affordability may lead to a surge in demand, but this boost could be temporary. Long-term performance will depend on the company’s underlying fundamentals, including revenue growth, market share stability, and the ability to navigate competitive pressures within the semiconductor industry.

Moreover, AVGO faces certain challenges that could impact its stock trajectory. The ongoing global semiconductor shortage and supply chain disruptions present significant hurdles that the company must overcome. Additionally, fluctuations in technology demand and potential regulatory scrutiny could also affect AVGO’s operation and market position. Investors would do well to keep abreast of these external factors as they evaluate their investment in AVGO.

For current shareholders, it is crucial to adopt a long-term perspective and assess the company’s strategies in light of its split. Diversification of the portfolio might also be advisable, particularly given the volatile nature of tech stocks. For those contemplating entering the AVGO market post-split, thorough research and consideration of market conditions and the company’s performance metrics will be vital. Ultimately, while the stock split can invigorate investor sentiment, the future success of AVGO will greatly hinge on its operational execution and adaptability in a dynamic market landscape.