Introduction to AVGO and Stock Splits

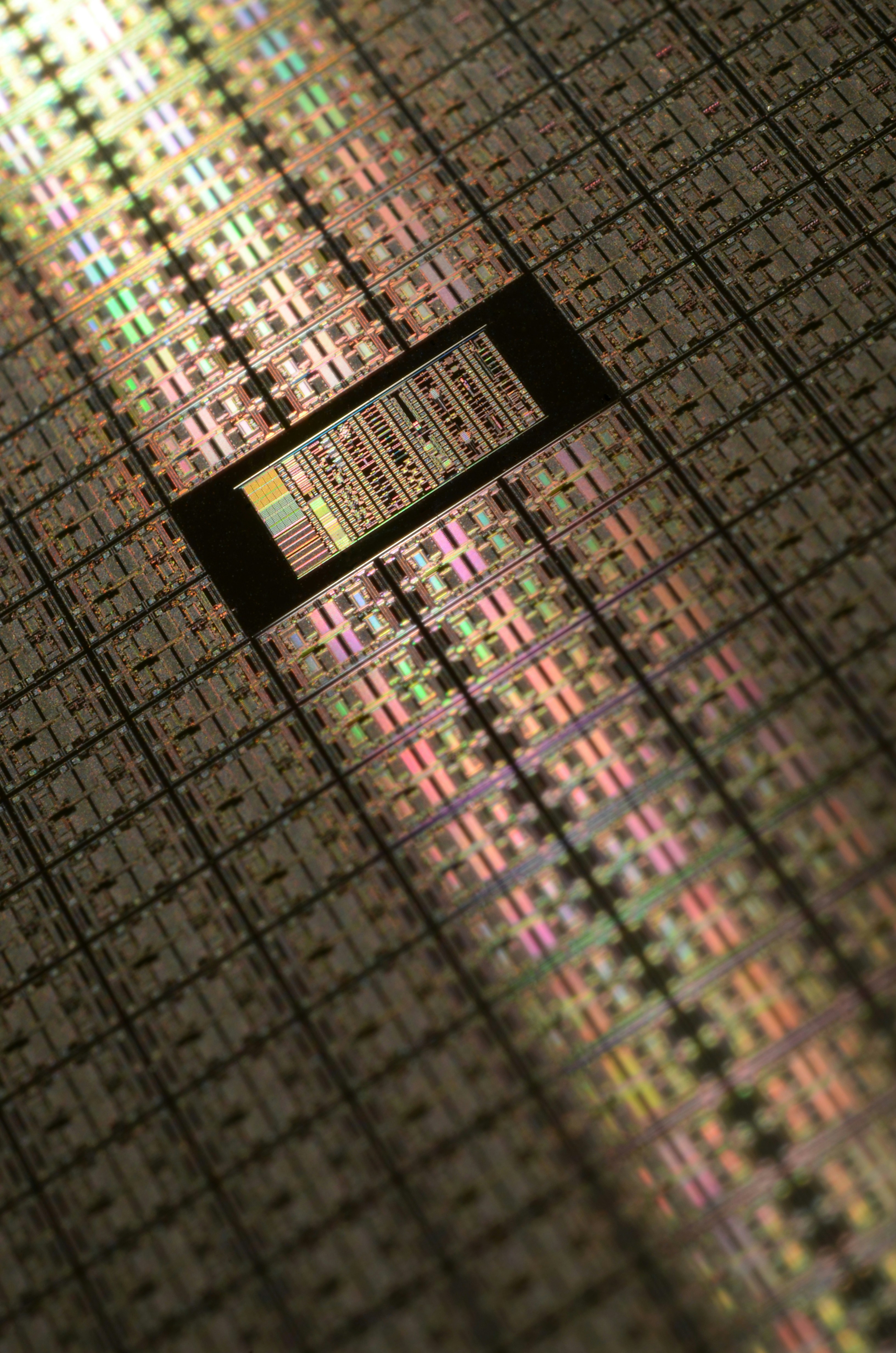

Broadcom Inc. (NASDAQ: AVGO) is a prominent player in the semiconductor industry, renowned for its extensive portfolio of products utilized in various technological applications, including telecommunications, data centers, and consumer electronics. As a key provider of essential semiconductor solutions, Broadcom holds a substantial position in shaping the landscape of modern electronics. The company’s ability to innovate and adapt to the rapidly evolving technology sector has solidified its reputation and made it a significant investment option for many investors.

A stock split is a corporate action that increases the number of a company’s outstanding shares while proportionally reducing the share price. For instance, in a 2-for-1 stock split, each existing share would be divided into two shares, effectively halving the share price but leaving the overall market capitalization unchanged. This mechanism serves to boost liquidity and make shares more affordable to a broader base of investors. By lowering the individual share price, companies aim to attract more investors and increase trading volume, promoting higher demand for their stock.

Companies like Broadcom consider stock splits for various reasons. One primary motivation is to ensure that the stock remains accessible to retail investors, as high share prices can create a barrier to entry. Additionally, stock splits can signal confidence in the company’s growth prospects, suggesting that management believes the stock will continue to rise in value. As such, the potential stock split of AVGO has garnered significant attention among investors, reflecting the broader implications of such a decision within the semiconductor sector and the investment community at large. Understanding these dynamics is crucial for investors contemplating their next moves in the stock market.

The Benefits of a Stock Split for Investors

A stock split can provide several advantages for investors, influencing both market dynamics and individual trading behavior. One of the most immediate benefits is the enhancement of liquidity. When a company’s stock undergoes a split, the number of shares available in the market increases, making it easier for investors to buy and sell shares. This heightened liquidity can help reduce bid-ask spreads, lowering transaction costs for investors and fostering a more efficient market.

Additionally, stock splits can significantly improve accessibility for smaller investors. By lowering the share price through a split, shares become more affordable for a broader range of investors. This democratization of access encourages participation from retail investors who might have previously felt priced out of investing in high-value stocks. Moreover, the more reasonable price point can stimulate buying interest, leading to increased volume and potentially driving up the stock price.

The psychological impact of a stock split cannot be overlooked. Investors often perceive lower-priced stocks as more attainable or as offering greater potential for future gains. This psychological effect can lead to increased demand as more investors flock to the stock, eager to capitalize on perceived opportunities. This phenomenon acts as a catalyst, enhancing investor sentiment and potentially benefiting the company’s market valuation.

Historical examples illustrate these benefits effectively. Companies like Apple and Tesla experienced significant price increases following their stock splits, attracting new investors and increasing overall market interest. In such cases, stock splits have often been met with enthusiasm, as they signal underlying confidence from management about the company’s future prospects.

In considering the potential hopes pinned to AVGO stock, understanding these aspects of stock splits provides a clearer picture of how such corporate actions can positively impact investor engagement and market perception.

Analyzing AVGO’s Financial Health and Market Trends

Broadcom Inc. (AVGO) has consistently demonstrated strong financial performance, which is a critical aspect for investors contemplating the potential for a stock split. In its recent earnings reports, the company has showcased impressive revenue growth, with consistent year-over-year increases that highlight its resilience in the competitive semiconductor sector. For instance, in the latest quarterly earnings announcement, AVGO reported a revenue increase of approximately 20% compared to the same period last year, driven primarily by robust demand for semiconductor solutions across various sectors, particularly in cloud computing and networking.

Profit margins also play a significant role in assessing AVGO’s financial health. The gross margin reported was around 60%, indicating efficient cost management and strong demand for its products and services. Such healthy margins not only underline the company’s ability to generate profits but also signal potential for ongoing investment in innovation and expansion. As AVGO continues to capitalize on emerging technologies like 5G and the Internet of Things (IoT), these factors will likely contribute to sustained financial performance.

In addition to internal financial metrics, external market trends are influencing investor perception and may impact the discussion around a potential stock split. The semiconductor industry is experiencing significant growth, spurred by advancements in technology and an increasing demand for electronic devices. Market analysts project a positive trajectory for the semiconductor space, with estimates indicating overall growth rates of approximately 10% annually over the next five years. As AVGO aligns its business strategy with this growth, it stands to benefit from favorable market dynamics.

Furthermore, AVGO’s trading history and share price movements have been relatively stable compared to industry peers, maintaining a competitive position. Examining its price-to-earnings ratio in relation to competitors provides insights into market valuation perspectives. As investors contemplate the implications of these financial health indicators and market trends, it becomes evident that Broadcom Inc. is well-positioned to make informed decisions regarding potential corporate actions, including a stock split, as they look toward future growth opportunities.

Expert Opinions and Market Predictions

As the speculation around a potential AVGO stock split continues to intensify, financial analysts and industry experts offer varying perspectives on the likelihood of such an event. Many experts believe that Broadcom (AVGO) is in a strong financial position that could support a split, especially given its commendable performance in recent years. With consistent revenue growth and a robust cash flow, several analysts predict that the company may consider a split to enhance accessibility for retail investors and increase liquidity in the market. This sentiment resonates with the broader strategy that many successful firms, particularly in the tech sector, have adopted when experiencing significant growth.

Market predictions indicate that if Broadcom decides to proceed with a stock split, it could occur within a favorable market window, potentially aligning with upcoming earnings reports or major product announcements. Timing is crucial, as an opportune moment could maximize the stock’s visibility and impact. Some analysts have suggested that investors should closely monitor market conditions and corporate communications from Broadcom that may hint at strategic decisions, including a stock split.

While the prospect of a stock split could generate substantial interest among investors, it is essential to acknowledge the risks involved. An increase in share volume without a corresponding rise in the company’s fundamentals can lead to volatility in the stock price. Additionally, while some investors may view a split as a bullish signal, others may remain cautious, emphasizing that a stock split does not inherently enhance a company’s value. Therefore, it is vital for investors to weigh both the potential rewards and pitfalls before making investment decisions. Overall, sound judgment, thorough analysis, and reliance on expert insights remain paramount in navigating the uncertainties surrounding the future of AVGO stock.