Understanding Nvidia’s Market Position

Nvidia Corporation has firmly established itself as a leading player in the semiconductor and technology sectors, particularly known for its innovative graphics processing units (GPUs). The company’s market valuation has seen remarkable growth, especially in light of its advancements in artificial intelligence (AI) technology. As of October 2023, Nvidia’s stock prices have surged dramatically, reflecting investor confidence in its capacity to dominate the ever-expanding AI landscape. This bullish sentiment can be attributed to several key factors that solidify Nvidia’s market position.

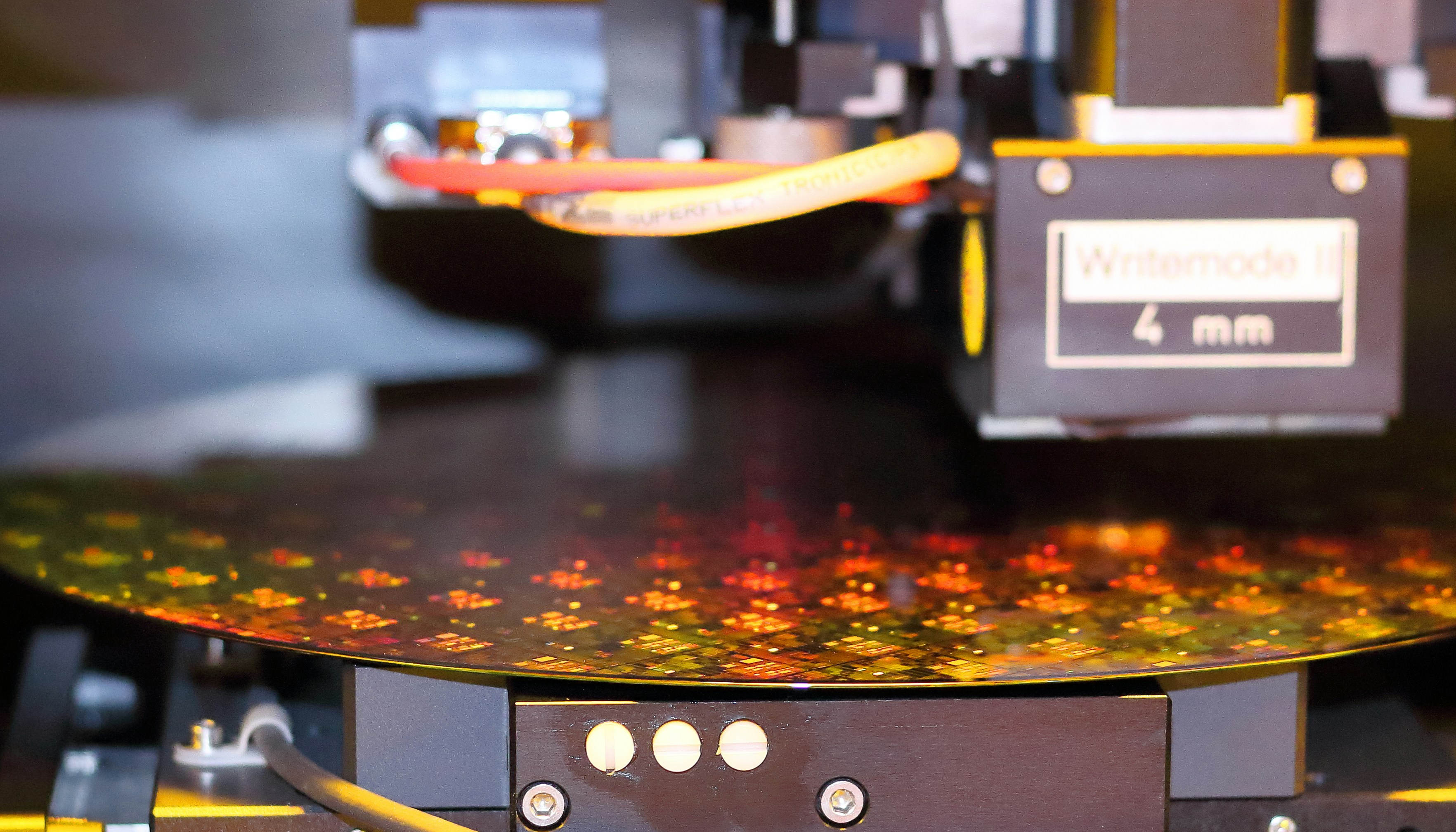

Firstly, Nvidia’s commitment to research and development (R&D) in GPU technology allows it to maintain a significant edge over competitors. The company’s GPUs are not limited to gaming but are also instrumental in AI and machine learning applications. The versatility of these chips has resulted in an increased demand within data centers, where companies are looking to enhance computational power to leverage AI technologies effectively. As organizations strive to harness the potential of big data and machine learning, Nvidia’s products are becoming essential components of modern computing infrastructures.

Moreover, Nvidia’s strategic partnerships and collaborations have facilitated its expansion into various sectors, ranging from cloud computing to automotive technology. The company has aligned itself with major cloud service providers, which has further amplified demand for its technologies. Additionally, innovations such as the Nvidia AI Enterprise suite showcase its ability to cater to diverse market needs and positions the company as a frontrunner in the AI revolution.

This confluence of advanced technology, strategic positioning, and burgeoning demand for AI applications suggests that Nvidia’s market trajectory is not only likely to continue its upward momentum but could also steer the company towards a remarkable valuation of $5 trillion in the foreseeable future. The groundwork laid by Nvidia’s leadership in GPU technology and AI innovations presents a compelling case for its sustained growth and market dominance in the tech industry.

The Role of Artificial Intelligence in Nvidia’s Growth

Artificial intelligence (AI) has emerged as a pivotal force driving Nvidia’s remarkable expansion in recent years. Known for its high-performance graphics processing units (GPUs), Nvidia has successfully positioned itself at the forefront of the AI revolution by continuously innovating its product offerings. The company’s advanced GPU architectures, such as the Ampere and the upcoming Hopper architecture, have made substantial strides in enhancing AI processing capabilities. These architectures are specifically designed to handle the massive computational demands of AI workloads, fostering an environment conducive to rapid development and deployment of AI applications.

Furthermore, Nvidia’s strategic investments in AI research and development have fostered groundbreaking advancements in deep learning and machine learning technologies. The introduction of platforms like Nvidia CUDA and TensorRT has provided developers with the tools necessary to leverage AI efficiently, accelerating their projects from conception to execution. As a result, industries ranging from healthcare to finance now utilize Nvidia’s products to harness AI, thereby broadening the company’s market reach.

The company’s collaborations with esteemed partners, including major cloud service providers and leading academic institutions, have further fueled its growth. By aligning with entities at the cutting edge of AI research, Nvidia is leveraging external expertise while ensuring that its products remain integral to the future of AI technologies. This synergistic approach not only enriches Nvidia’s product portfolio but also underscores its commitment to driving AI innovation at an unprecedented scale.

As AI continues to evolve and permeate various sectors, the implications for Nvidia’s revenue and stock performance are profound. Analysts predict that the sustained demand for AI capabilities could lead to a significant uptick in both sales and investor interest, reinforcing Nvidia’s position as a leader in this dynamic field. The convergence of AI advancements and Nvidia’s technological prowess creates a compelling narrative for potential investors, leading them to consider the stock as a prime opportunity in the context of AI-driven growth.

Analyzing Investment Opportunities

As Nvidia continues to make strides in artificial intelligence and other groundbreaking technologies, investors are increasingly considering the potential financial implications of entering this dynamic market. With the company’s valuation rapidly climbing, many analysts are projecting a possible price surge of 50% in just a short span of 48 hours. This remarkable growth potential has caught the attention of both seasoned and novice investors alike. To grasp this opportunity effectively, an in-depth analysis of various investment indicators is crucial.

Technical indicators, such as moving averages and relative strength index (RSI), suggest that Nvidia shares are seeing significant upward momentum. Recent market trends indicate that the stock has remained resilient amidst broader market fluctuations, highlighting a positive sentiment surrounding Nvidia’s innovation capabilities. Furthermore, social media chatter and investor forums are ablaze with enthusiasm regarding the company’s potential role in the AI revolution, further influencing market sentiment in a favorable direction.

Expert opinions enhance this optimistic outlook, with numerous investment firms expressing bullish sentiments on Nvidia stock. Analysts often cite the company’s strong financials and strategic positioning in the tech landscape as capitalizing factors to justify a buy recommendation. However, it is imperative to approach this investment with a cautious mindset. The tech sector can be notoriously volatile, and while future growth seems promising, potential investors must weigh the risks accordingly.

In conclusion, the prospect of investing in Nvidia presents unpredictable yet exciting opportunities. By carefully considering technical indicators, market sentiment, and expert analysis, investors can make informed decisions about capitalizing on Nvidia’s anticipated growth while remaining mindful of the inherent risks involved in market fluctuations.

Predictions for the Future: Where is Nvidia Headed?

The future of Nvidia appears to be promising, as analysts speculate that the company could reach an astounding $5 trillion market cap. This ambitious target primarily stems from Nvidia’s dominance in the AI and graphics processing sectors, where the demand for advanced computing technologies continues to rise. Industry experts have been quick to emphasize the potential upside of investing in Nvidia, particularly given the relentless growth of artificial intelligence applications across various industries including healthcare, automotive, and financial services.

One significant factor that could bolster Nvidia’s market position is its existing partnerships and collaborations. As AI becomes more integral to business operations, organizations are likely to increasingly rely on Nvidia’s advanced hardware and software solutions. Furthermore, emerging technologies, such as quantum computing and edge AI, may enhance Nvidia’s portfolio and contribute to a substantive increase in revenue streams.

However, while the prospects seem bright, potential challenges must be acknowledged. The tech sector is experiencing rapid competition, with numerous players vying for dominance in AI and machine learning. Companies such as AMD and Intel are also investing heavily in their products and technological advancements, therefore intensifying the pressure on Nvidia to innovate continually and maintain its market share. Another critical factor to consider is the economic climate, which includes fluctuations in consumer demand and changes in government regulations that might impact the tech industry.

In conclusion, Nvidia stands at a pivotal juncture, and its trajectory toward the $5 trillion market cap will depend on its ability to navigate both opportunities and challenges effectively. Investors should keep a close eye on market trends and analyst predictions, as these insights can provide valuable indicators for making informed investment decisions in the ever-evolving tech landscape.