Introduction to Marvell Technology

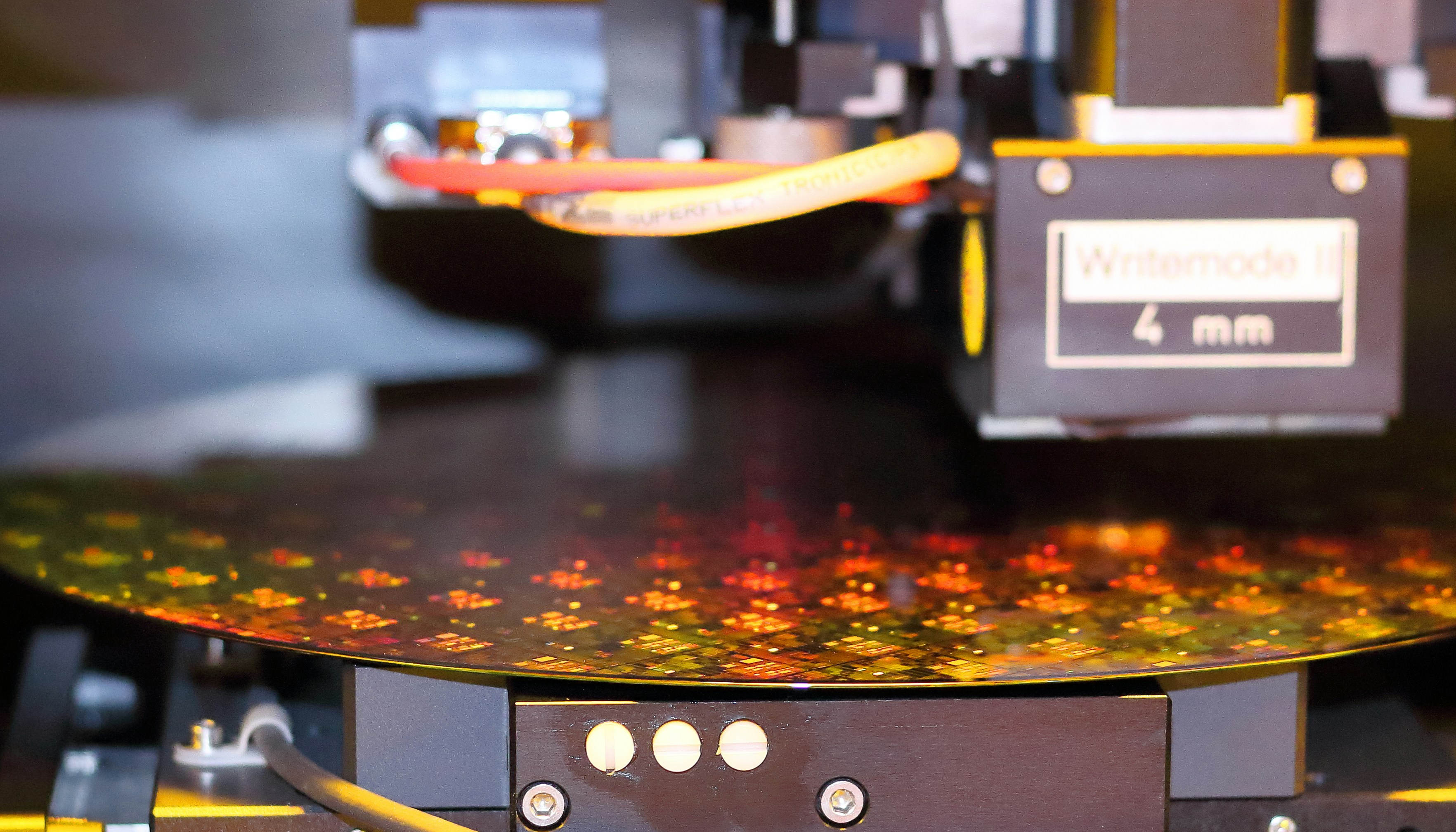

Marvell Technology, Inc. is a prominent player in the semiconductor industry, recognized for its innovative solutions that cater to a wide range of applications. Founded in 1995, the company has established itself as a leader in the design and manufacturing of storage, processing, and networking semiconductors. Headquartered in Santa Clara, California, Marvell operates globally, serving various sectors, including data centers, telecom, automotive, and industrial markets.

The core products offered by Marvell include high-performance data infrastructure solutions that enable efficient data processing and storage capabilities. These products are instrumental in meeting the demands of an increasingly data-centric world, where speed and efficiency are paramount. Their portfolio encompasses a variety of components such as application-specific integrated circuits (ASICs), Ethernet switches, and optical networking solutions, which are essential for enhancing connectivity and performance in both enterprise and cloud environments.

In recent years, Marvell has strategically positioned itself to capitalize on the booming demand for artificial intelligence (AI) and machine learning technologies. The growing need for advanced processing power and data handling capabilities has led to an uptick in demand for Marvell’s ASICs specifically designed for AI workloads. Their products not only support high-speed data transfer but also facilitate the seamless integration of AI technologies into existing systems, thereby improving operational efficiency and performance.

This focus on AI and its related technologies has positively influenced Marvell’s growth trajectory, allowing it to expand its market share within the semiconductor sector. By aligning its offerings with current trends and customer needs, Marvell has positioned itself as a critical enabler of AI-driven advancements. This foundation sets the stage for a detailed examination of the company’s recent performance and how AI demand has specifically impacted its business outcomes.

The Impact of AI Demand on Marvell’s Performance

The demand for artificial intelligence (AI) technologies has significantly influenced Marvell’s performance during the first quarter of the fiscal year. AI’s growing prominence across various industries has catalyzed an uptick in demand for advanced semiconductor solutions, of which Marvell is a critical supplier. The company’s financial reports indicated a notable revenue growth, which can be primarily attributed to the rising need for chips that support AI functionalities. As businesses increasingly adopt AI technologies, the requirement for high-performance processing capabilities intensifies, thereby benefiting companies like Marvell that are at the forefront of the semiconductor industry.

Moreover, Marvell has placed a strong emphasis on product innovation tailored to meet the needs of the AI sector. The company’s commitment to developing cutting-edge solutions, such as specialized processors optimized for machine learning and data processing, has allowed it to capture a substantial market share. By focusing on enhancing its product portfolio, Marvell is not only addressing current demand but is also anticipating future trends in AI technologies. This proactive approach positions the company as a vital player amidst the expanding landscape of AI integration.

In conjunction with its innovative products, Marvell’s strategy includes forging partnerships and collaborations that leverage AI capabilities, thereby further embedding itself into the AI ecosystem. Such initiatives have helped strengthen its competitive edge and market reach, affirming its status as a leader in semiconductor technologies. As the global demand for AI applications continues to grow, Marvell’s alignment with this trend is proving to be a strategic advantage, allowing the company to not only enhance its performance metrics but also establish a solid foundation for sustainable growth in the future.

Financial Results for Q1: Key Highlights

Marvell Technology, a leader in the semiconductor industry, reported impressive financial results for the first quarter of the fiscal year. The company’s revenue reached $1.54 billion, marking a year-over-year increase of 26%, driven primarily by the surging demand for AI-related technologies. This growth trajectory underlines the strategic focus of Marvell on advanced networking and data infrastructure, which have become pivotal in facilitating AI advancements across multiple sectors.

Furthermore, the earnings per share (EPS) for the quarter stood at $0.48, surpassing analysts’ expectations. This positive deviation reflects the company’s efficient cost management and operational scalability in a competitive market landscape. The rise in EPS, compared to the previous year’s figure of $0.36, is indicative of the effective implementation of Marvell’s growth strategies, particularly in the areas of cloud and enterprise networking solutions.

On an operational level, Marvell achieved notable milestones that contributed to these financial results. The company successfully launched several new product lines, including advanced chips specifically designed for AI, which have garnered significant interest from major tech firms. These products are expected to strengthen Marvell’s market position and enhance its competitive edge within the semiconductor space. Retail investors remain optimistic about the company’s direction, demonstrating confidence in Marvell’s ongoing innovations and its ability to capitalize on the growing AI market. The robust performance in Q1, despite a recent dip in stock price, showcases the potential for future growth as AI demand continues to escalate across industries.

Stock Market Reaction: Analyzing the Drop

Despite Marvell’s robust first-quarter results, which showcased the growing demand for artificial intelligence (AI) solutions, the company’s stock experienced a notable decline in the aftermath of its earnings announcement. This unexpected downturn raises pertinent questions regarding the interplay between market expectations, investor sentiment, and broader economic influences that may impact stock performance.

Initially, Marvell’s quarterly report indicated a significant increase in revenue driven by AI-related products, positioning the company as a key player in a rapidly evolving market. However, stock prices often do not move in tandem with earnings reports, as they are heavily influenced by investor expectations. In this case, the disappointment stemmed from the market’s anticipation of even more pronounced growth or guidance that failed to meet optimistic projections set prior to the announcement. Consequently, this misalignment contributed to a sense of letdown among investors, which is reflected in the stock’s decline.

Moreover, investor sentiment plays a critical role in shaping market reactions. In the world of finance, emotions such as fear and uncertainty can sway decisions and lead to volatility. Following the earnings report, concerns surrounding the sustainability of high growth rates were voiced, particularly in light of potential economic headwinds. As inflation, interest rates, and global supply chain issues loom large, investors may have become cautious, prompting them to reassess their positions in high-growth stocks like Marvell.

Add to this a broader market context that is rife with fluctuations; external economic factors can heavily influence stock performance. For instance, recent changes in monetary policy or geopolitical tensions may have fostered a negative outlook, further exacerbating the drop in Marvell’s stock price. Ultimately, while the underlying fundamentals of the company appear strong in the long term, immediate market reactions can often amplify short-term volatility.

Retail Investors’ Perspective: Confidence Amidst Fluctuations

In the wake of Marvell Technology Group Ltd.’s recent earnings report, retail investors have exhibited a complex mix of sentiment and trading behavior. Despite the company delivering an outperformance in its first quarter, the subsequent decline in stock price has prompted many retail investors to carefully reassess their positions. This analysis highlights how these investors are interpreting the fluctuations in Marvell’s stock and the broader implications for their investment strategies.

While institutional investors often wield significant influence over stock performance, retail investors are recognizing the long-term potential of Marvell, particularly in the context of artificial intelligence (AI) advancements driving demand for semiconductors. The recent earnings report, showcasing strong revenue growth driven by AI applications, has fortified the belief among many retail traders that Marvell’s fundamentals remain robust. Many consumers of stock have been monitoring trading volumes closely, and an uptick in activity suggests that retail investors are seizing perceived opportunities to acquire shares at a lower price point.

Notably, discussions on trading forums and social media platforms reveal an underlying confidence among retail investors. Many see the current price drop not as a reflection of fundamental weakness but rather as a short-term market reaction. Such opinions are frequently reinforced by analysis from financial influencers who advocate for a balanced approach while navigating market volatility. This sentiment reflects a broader trend where retail investors are becoming more educated and engaged, wielding their influence as they adjust their portfolios according to market conditions.

Overall, retail investors appear poised to stay committed to Marvell’s stock, emphasizing a long-term perspective. Their continued trading activity suggests that despite short-term fluctuations, there is a strong belief in the company’s growth trajectory, particularly as the demand for AI-driven technologies continues to expand. As retail investors maintain their confidence, the collective sentiment can play a pivotal role in stabilizing Marvell’s share price in the face of temporary market uncertainties.

Comparative Analysis with Industry Peers

In assessing Marvell Technology’s recent quarterly results, it is essential to situate its performance within the broader context of the semiconductor industry. When juxtaposed with prominent competitors such as NVIDIA, Intel, and AMD, Marvell’s metrics offer valuable insights into its market positioning and strategies that are heavily influenced by burgeoning AI demand.

Financially, Marvell reported strong results for Q1, highlighting a significant increase in revenue attributed primarily to its AI-related products. In contrast, NVIDIA has also shown impressive growth, driven largely by its dominance in AI graphics processing units (GPUs). While Marvell’s revenue growth was commendable, NVIDIA’s surge arguably positions it as the leader in capitalizing on AI opportunities, reflecting the intense competition in the sector. Conversely, Intel has experienced a more challenging landscape, with increased competition in both AI and traditional semiconductor markets resulting in a slower recovery in its fiscal performance.

Market strategies diverge significantly among these companies. Marvell has adopted a focused approach, rapidly aligning its product offerings to meet the demands of AI-centric applications. This strategy is crucial as AI influences various sectors that require innovative semiconductor solutions. NVIDIA’s stronghold in the GPU market grants it a competitive edge, whereas AMD has made notable gains in the CPU segment, also beginning to penetrate AI applications with its advancing technology.

Furthermore, the influence of AI demand is an undeniable theme across the semiconductor industry. While Marvell positions itself as a key player in this space, it operates within an ecosystem where other established companies like NVIDIA and AMD are continuing to innovate and expand their market share. This competitive landscape underscores the importance of continuous adaptation and investment in research and development to maintain relevance in this rapidly evolving market. Each player’s ability to navigate AI-driven transformations will be instrumental in determining their success in the coming quarters.

Expert Opinions and Analyst Predictions

As the landscape of artificial intelligence continues to evolve, Marvell Technology has emerged as a key player in the semiconductor sector, specifically targeting AI applications. Financial analysts have weighed in on Marvell’s recent performance, highlighting both opportunities and challenges that may influence its stock trajectory in the coming quarters.

Many experts are optimistic about Marvell’s growth potential, largely driven by increasing demand for AI capabilities across various industries. The proliferation of AI technologies is catalyzing a surge in the need for robust semiconductor solutions, which positioned Marvell well to capture significant market shares. Analysts have pointed to Marvell’s innovative product offerings—such as its AI-focused chips—as a critical differentiator. The company’s alignment with cloud service providers and AI-driven enterprises is expected to bolster revenue streams, suggesting an optimistic future outlook.

However, it is essential to consider the associated risks that could impact Marvell’s growth narrative. Whispers of supply chain disruptions, competitive pressures, and potential regulatory challenges have caused some analysts to issue cautionary notes. Marvell’s business model relies heavily on its ability to innovate swiftly and maintain cost-effective manufacturing processes. If these elements falter, the company could face setbacks in meeting investor expectations.

The overall market outlook for AI-driven technologies remains robust, yet volatile, with numerous macroeconomic factors at play. Industry experts suggest that while Marvell is well-positioned to capitalize on the ongoing AI boom, it must navigate complexities within the semiconductor market carefully. As a result, investor sentiment appears to favor a long-term perspective, mitigating immediate concerns about stock drops in light of Marvell’s recent quarterly performance.

Future Projections for Marvell Technology

As we look towards the future for Marvell Technology, several factors will likely influence the company’s trajectory in the coming quarters. One of the primary opportunities lies in Marvell’s commitment to innovation, particularly within sectors that are increasingly influenced by artificial intelligence (AI). The continuous advancements in AI technology not only present a significant opportunity for growth but also necessitate ongoing investment in research and development. Marvell’s upcoming product launches are expected to align with these technology trends, providing solutions that specifically cater to the demands of AI-driven applications.

However, it is essential to remain cognizant of potential challenges facing the semiconductor industry. Supply chain disruptions that have plagued many manufacturers may continue to impact Marvell, particularly as they scale their operations to meet rising demand for their products. Moreover, fierce competition from other semiconductor firms presents both a challenge and an impetus for Marvell to remain at the forefront of innovation. By focusing on their goal to deliver high-performance, secure, and intelligent solutions, Marvell can strategically position itself to outpace competitors while addressing market needs.

Additionally, as Marvell adapts to shifting market trends, an evaluation of consumer behavior and technology requirements will be crucial. The growing demand for cloud services and data-intensive applications is likely to propel the need for efficient chip solutions, offering Marvell a competitive edge should they execute their strategies effectively. Furthermore, collaboration with other technology firms, particularly in the AI sector, may enhance Marvell’s market presence and expand its reach across new customer segments.

In conclusion, Marvell Technology is steered by both opportunities brought forth by advancing AI capabilities and challenges inherent in the semiconductor landscape. By proactively embracing innovation and addressing potential obstacles, Marvell can navigate its future prospects successfully.

Conclusion: The Road Ahead for Marvell

Marvell Technology has showcased remarkable resilience in the first quarter, powered by burgeoning demand for artificial intelligence (AI) technologies. This has positioned the company favorably amidst a dynamic market landscape. During this period, Marvell excelled in various sectors, effectively capitalizing on the heightened need for advanced semiconductor solutions critical to AI applications. Even as stock prices experienced fluctuations, largely influenced by broader investor sentiment, it is clear that Marvell’s fundamentals remain robust.

The stock market, known for its volatility, can sometimes reflect transient sentiments that do not accurately represent a company’s intrinsic value. Marvell’s strong quarterly performance, underscored by impressive revenue growth and strategic advancements in AI deployment, suggests a long-term trajectory that is less impacted by short-term stock volatility. Investors are increasingly cognizant of the role that sophisticated semiconductors play in real-world AI applications, which bodes well for Marvell’s future prospects.

To bolster investor confidence, it is imperative for Marvell to maintain transparency in its business strategies and consistently communicate its vision for tapping into the AI market’s potential. Engaging with stakeholders through regular updates and highlighting continued growth in areas such as high-performance computing and networking technologies could foster improved market trust. Additionally, as competition in the semiconductor space intensifies, continued innovation will be essential for sustaining a competitive edge.

In summary, while the stock’s performance may exhibit short-term fluctuations, Marvell’s strategic emphasis on AI demand aligns well with industry trends, suggesting a promising outlook. By reinforcing its position as a leader in semiconductor solutions essential for AI advancements, Marvell has the potential to retain investor faith and navigate future market challenges effectively.