Introduction to NVIDIA and its Market Position

NVIDIA Corporation, founded in 1993, has established itself as a leading manufacturer of graphics processing units (GPUs) known for their high performance and efficiency. Initially focused on accelerating 3D graphics in the gaming industry, the company has diversified its offerings to include artificial intelligence (AI), data center solutions, and automotive technology. This evolution underscores NVIDIA’s adaptability and its pivotal role in shaping technological advancements across various sectors.

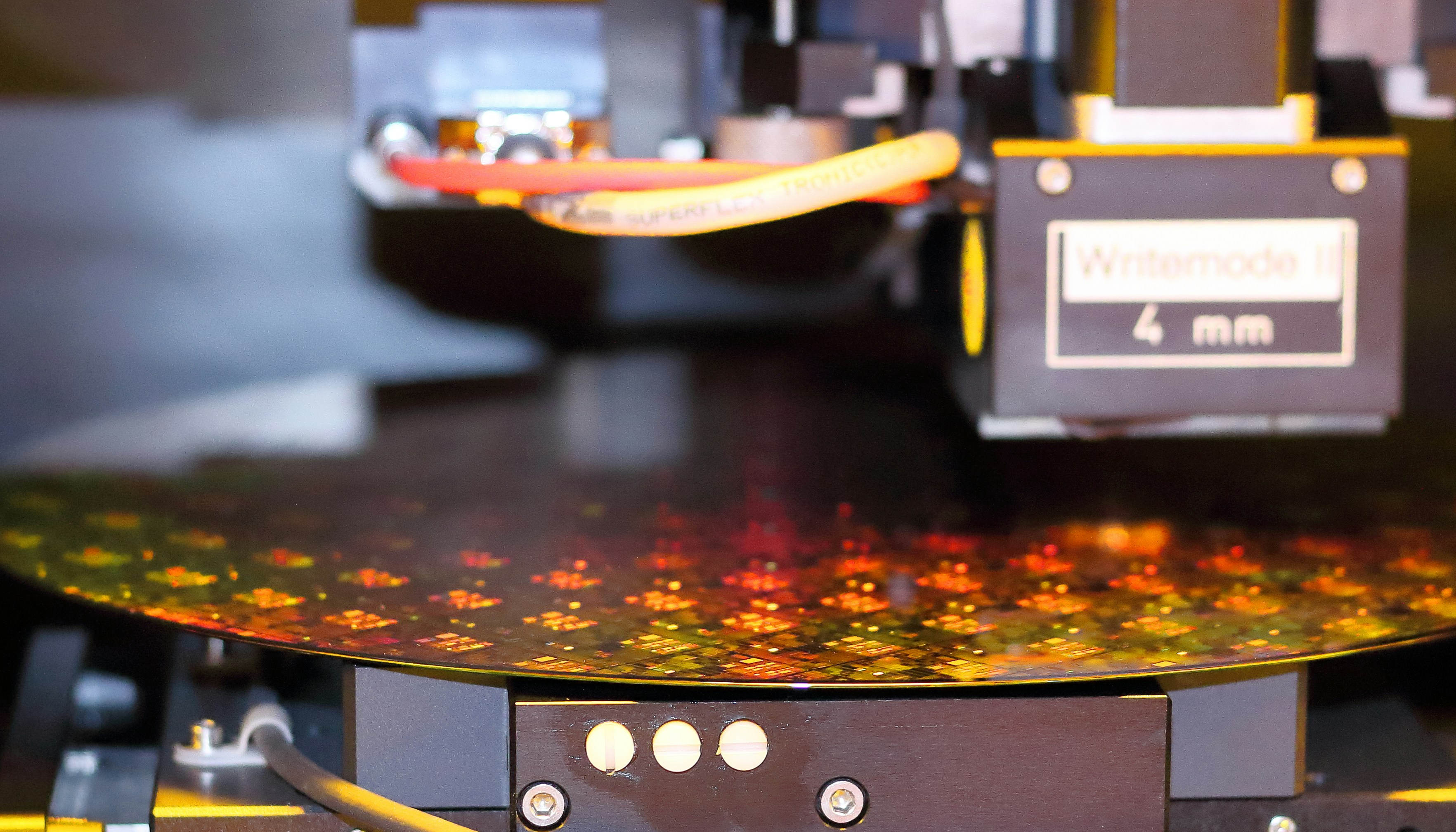

The company’s flagship products, including the GeForce line of gaming GPUs, the Quadro series for professionals, and the Tesla and A100 series for data centers, demonstrate its dominance in the market. NVIDIA’s GPUs are widely regarded for their ability to handle demanding graphical tasks—making them indispensable for gamers, designers, and researchers alike. Additionally, the company’s innovations in AI and deep learning have positioned it as a critical player within the rapidly growing tech landscape.

NVIDIA’s stock has garnered attention from investors due to its impressive performance on the stock market. The company’s shares have seen significant appreciation in value, driven by a combination of exceptional revenue growth, increasing demand for GPUs, and a strategic focus on high-growth sectors such as AI and machine learning. This has resulted in NVIDIA being consistently ranked among the top-performing stocks in the technology sector.

With the rise of applications like autonomous vehicles, cloud computing, and AI-driven solutions, NVIDIA’s market position continues to strengthen. Its commitment to research and development ensures that it remains at the forefront of technological innovation. As we delve deeper into the factors influencing NVIDIA’s stock price, understanding the fundamental aspects of the company and its market standing will provide essential context for the analysis to follow.

Recent Trends in NVIDIA Stock Price

Over the past year, NVIDIA’s stock price has exhibited remarkable fluctuations, demonstrating both resilience and volatility in response to various market dynamics. Commencing at approximately $160 in the beginning of the year, NVIDIA’s share price saw an upward trajectory, propelled by strong earnings reports and significant advancements in the fields of artificial intelligence and gaming technologies. Notably, the company’s valuation surged past the $300 mark by mid-summer, ultimately peaking at around $480 in late August before experiencing a correction.

Key milestones played a pivotal role in shaping NVIDIA’s stock price trajectory. These include the anticipation and subsequent release of breakthrough products within the GPU market, especially the GeForce RTX 40 series, which ignited consumer interest and demand. Moreover, the announcement of strategic partnerships within the AI sector allowed NVIDIA to capitalize on the increasing reliance on AI applications, thereby enhancing investor confidence and driving share prices higher.

In addition to product launches, macroeconomic factors and competitor behavior contributed to the stock’s movements. For instance, NVIDIA’s performance was often compared with other tech giants such as AMD and Intel, with industry shifts toward AI and machine learning technologies further emphasizing NVIDIA’s dominant position. In response to earnings reports from its peers, NVIDIA’s trades showed market reactions that reflected investors’ sentiment regarding its competitive advantage.

As observed, NVIDIA’s stock chart reveals pronounced spikes and corresponding declines, highlighting the effects of external economic indicators and internal operational strategies. The collective insights garnered from these trends position NVIDIA as a noteworthy entity in the tech sector, showcasing practices poised to influence its sustained growth trajectory in the future.

Factors Influencing NVIDIA’s Stock Price

NVIDIA’s stock price is influenced by a myriad of factors, encompassing both macroeconomic variables and company-specific dynamics. On a macroeconomic scale, market trends play a significant role in shaping investor sentiment and stock valuation. For instance, the technology sector has seen considerable fluctuations influenced by overall market performance, interest rates, and inflationary pressures. Higher interest rates may dampen consumer spending and investment in technology, potentially impacting NVIDIA’s stock performance.

Furthermore, inflation can erode consumer purchasing power, potentially affecting demand for NVIDIA’s products, particularly in the gaming and AI sectors. The perception of economic stability can lead to shifts in market confidence, which in turn impacts stock prices of technology firms like NVIDIA. Fluctuations in global market indices can either bolster or depress NVIDIA’s performance, depending on overall investor sentiment towards the tech sector.

On the company-specific front, NVIDIA’s financial performance is critical in determining its stock value. Strong quarterly earnings reports can lead to significant increases in stock prices, while disappointing results could have the opposite effect. Investors closely monitor growth potential in key sectors such as artificial intelligence and gaming, where NVIDIA holds a leading position. Strategic partnerships, product innovations, and market adaptations also contribute to investors’ outlook on NVIDIA’s future profitability.

Additionally, regulatory impacts must be considered. Changes in government policies, trade relations, and compliance requirements can affect operational efficiencies and market access for NVIDIA. Global supply chain considerations, particularly in the semiconductor market, further complicate the landscape, as disruptions can lead to production delays or increased costs. Overall, a combination of these factors creates a complex environment that shapes NVIDIA’s stock price trajectory.

Future Outlook and Predictions for NVIDIA Stock

Forecasting the future trajectory of NVIDIA’s stock price requires careful consideration of various factors, including market trends, expert predictions, and the company’s innovative capabilities. Analysts have expressed a generally optimistic view regarding NVIDIA’s potential for long-term growth, stemming from its leadership in the realm of artificial intelligence, gaming, and data center solutions. The growing demand for AI-driven applications positions NVIDIA as a critical player, likely propelling its stock performance in the forthcoming years.

Market projections indicate that NVIDIA’s continued success in the semiconductor industry, combined with the increasing relevance of AI technologies, may lead to significant earnings growth. Innovations such as new graphics processing units (GPUs) and advancements in cloud computing services are anticipated to enhance NVIDIA’s competitive edge. Experts also recommend closely monitoring the company’s forays into areas like automotive technology and machine learning, as these ventures could substantially impact its stock trajectory.

However, it is essential to balance optimism with caution. The technology sector is notoriously volatile, and investment in NVIDIA also entails certain risks. Factors such as global supply chain disruptions, competition from rival firms, and changing regulatory environments may pose challenges ahead. Moreover, investors should be aware of the potential impact of macroeconomic conditions on consumer spending and technology investments.

In light of these dynamics, long-term investors might find value in NVIDIA due to its historical commitment to innovation and market leadership. By consistently enhancing its product offerings and adapting to emerging trends, NVIDIA is well-positioned to navigate future challenges. Although fluctuations may occur, the company’s strong foundation and growth strategies suggest a promising outlook for its stock price. Ultimately, vigilant monitoring of the industry landscape will be crucial for investors looking to capitalize on NVIDIA’s potential achievements.