1. What Will Berkshire Hathaway Be Worth in 5 Years?

Berkshire Hathaway is not built to explode in value quickly. It’s built to compound steadily.

Historically, Berkshire has grown at 8–11% annually over long periods. If that continues:

- In 5 years, Berkshire could be 40–60% more valuable than today

- This assumes no major global financial crisis

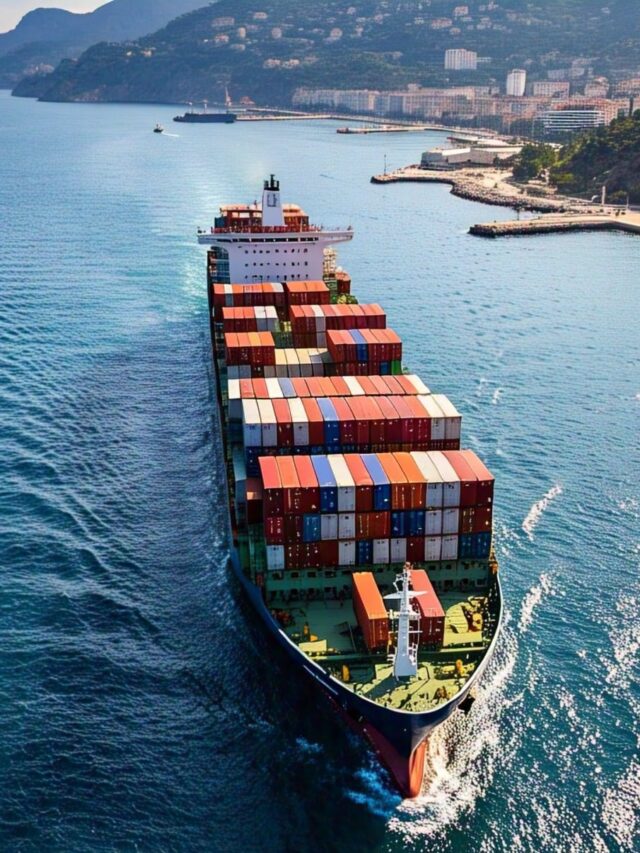

Think of Berkshire like a freight train—slow to accelerate, but incredibly powerful once moving.

2. Is Berkshire Hathaway a Forever Stock?

Yes, for many investors.

Berkshire is often called a “forever stock” because:

- It owns real businesses (insurance, energy, railroads, consumer brands)

- It holds massive cash reserves

- It avoids debt-heavy speculation

Many investors buy Berkshire with the intention of never selling.

3. Is Berkshire Hathaway Overpriced or Undervalued?

Most of the time, Berkshire trades at fair value.

- Rarely cheap

- Rarely extremely expensive

That’s intentional—management avoids hype and focuses on intrinsic value.

4. How High Will BRK.B Stock Go?

There is no fixed ceiling for BRK.B.

Realistic expectations:

- Moderate annual growth

- Strong downside protection

- Outperformance during market crashes

BRK.B is not designed to 10x quickly—it’s designed to protect and grow wealth slowly.

5. BRK.B Stock Price Forecast (2026, 2030, 2040)

BRK.B Forecast 2026

- Expected to be higher than today

- Growth driven by earnings, buybacks, and acquisitions

BRK.B Forecast 2030

- Likely significantly higher, assuming compounding continues

- Not explosive, but steady

BRK.B Forecast 2040

- Highly dependent on leadership execution

- Long-term investors could see substantial wealth creation

6. What Is the 10-Year Return on BRK.B Stock?

Historically:

- Around ~10% annualized over long periods

Some years outperform the market, others lag—but consistency is the strength.

7. Does BRK Outperform the S&P 500?

Compared to the S&P 500:

- Berkshire often outperforms during recessions

- Sometimes underperforms during tech-led bull markets

It is defensive excellence, not speculative growth.

8. Is BRK.B Still a Good Investment Today?

Yes—if you want:

- Stability

- Capital preservation

- Long-term compounding

No—if you want fast money.

9. Is BRK.B Paying Dividends?

No.

Berkshire reinvests profits internally, believing it can generate higher returns than paying dividends.

10. Why Is BRK.B Underperforming Sometimes?

Because Berkshire:

- Avoids meme stocks

- Holds large cash reserves

- Doesn’t chase trends

Underperformance in bull markets is the price of safety.

11. Will BRK.B Fall When Warren Buffett Dies?

Short-term volatility is possible.

Long-term:

- Succession plans are already in place

- The system matters more than the individual now

12. Will BRK.B Ever Split Again?

Very unlikely.

Berkshire intentionally avoids encouraging speculation.

13. What If You Invested $1,000 in BRK 20 Years Ago?

You’d likely have $6,000–$8,000+ today, depending on timing.

Not flashy—but reliable.

14. Is Berkshire Holding Cash?

Yes—hundreds of billions in cash equivalents.

This gives Berkshire:

- Crisis-buying power

- Stability during crashes

- Flexibility others don’t have

15. Which Is Bigger: Berkshire Hathaway or BlackRock?

- Berkshire: Larger operating businesses

- BlackRock: Larger assets under management

Different business models.

16. Warren Buffett’s Favorite Stock to Buy

Buffett doesn’t chase tickers.

His favorite “stock” is:

A wonderful business bought at a fair price

17. Warren Buffett’s Favorite Dividend Stock

One long-time favorite:

- Coca-Cola

Held for decades, not traded.

18. Warren Buffett’s Top 5 Dividend Stocks (Historically)

Common long-term holdings include:

- Coca-Cola

- Chevron

- American Express

- Apple (via buybacks)

- Kraft Heinz

19. What Is Warren Buffett’s Mystery Stock?

Sometimes Berkshire delays disclosure of purchases due to regulations.

These are later revealed in filings.

20. What Is the 8–8–8 Rule of Warren Buffett?

A simple life philosophy:

- 8 hours sleep

- 8 hours work

- 8 hours reading, learning, and thinking

Consistency beats intensity.

21. Can Nvidia Reach $500 or $1,000 by 2030?

Nvidia could reach those levels if:

- AI demand continues expanding

- Margins remain strong

- Competition doesn’t destroy pricing power

Possible—but not guaranteed.

22. Is It Too Late to Buy Nvidia Stock?

Not too late—but risk is higher than early-stage buyers.

Future returns will likely be lower than past returns.

23. What If You Invested $1,000 in Nvidia 20 Years Ago?

You’d be a multi-millionaire today.

But:

- Very few held that long

- The outcome was unknowable at the time

24. What Will 5,000 Nvidia Shares Be Worth in 5 Years?

Impossible to predict precisely.

Depends on:

- AI growth

- Valuation multiples

- Competition

25. Can Bitcoin Hit $1 Million?

Bitcoin could reach very high levels if:

- Global adoption increases

- Institutional demand grows

- Scarcity narrative holds

Not guaranteed.

26. What Will Bitcoin Be Worth in 2030 or 2040?

Estimates vary widely:

- 2030: $100K–$500K+

- 2040: Highly uncertain

27. Will Bitcoin End in 2040?

Unlikely.

Bitcoin has survived:

- Multiple crashes

- Regulatory threats

- Repeated “death” predictions

28. Can Solana Reach $10,000?

Solana reaching $10,000 is extremely unlikely due to supply math.

29. Can XRP Reach $50,000?

XRP reaching $50,000 is mathematically unrealistic.

30. Which Stock Can Give 1000x Return?

Extremely rare.

Usually involves:

- Early-stage startups

- Crypto tokens

- Very high failure rates

Most 1000x stories are known only in hindsight.

31. Which Stock Will Make Me a Millionaire in 10 Years?

There is no guaranteed answer.

Wealth is usually built by:

- Time

- Discipline

- Compounding

- Not chasing hype

32. Which Stock Will Double in 6 Months?

Highly speculative.

That’s trading, not investing.

33. Which Stock Will Skyrocket in 2025–2026?

Stocks that might surge usually sit in:

- AI infrastructure

- Energy transition

- Data centers

But timing is unpredictable.

34. Which Stocks Will Boom in the Next 5–10 Years?

Long-term winners usually:

- Solve real problems

- Generate cash flow

- Scale globally

35. Which Stock Can Give 1000% Return in India?

Possible only with:

- Small-cap companies

- High volatility

- Long holding periods

36. Which Stock Will 10x in 5 Years?

Possible, but statistically rare.

37. How to Turn $5,000 Into $1 Million?

Requires:

- High income growth OR

- High risk + long time

- Skill and luck

No safe shortcut exists.

38. Can I Live Off Interest of $1 Million?

Yes.

Typically:

- $40,000–$70,000 annually

- Depends on investment strategy

39. How to Get $1 Million in Savings?

Most realistic path:

- Consistent investing

- Time

- Discipline

- Compounding

40. Final Reality Check

- Berkshire Hathaway / BRK.B → slow, safe, long-term wealth

- Nvidia → high growth, higher risk

- Bitcoin → asymmetric upside, extreme volatility

- “1000x stocks” → mostly luck, not planning

The real secret:

Wealth is built by holding great assets longer than most people can stay patient.