Understanding Intel’s Current Market Position

Intel Corporation, a significant player in the semiconductor industry, has seen considerable fluctuations in its market performance due to the evolving landscape of technology and competition. As of the latest quarterly results, Intel’s revenue streams primarily arise from its data center and client computing segments, demonstrating a reliance on both enterprise and consumer markets. However, the company has faced challenges owing to increased competition from industry rivals such as AMD and NVIDIA, which have captured market share with innovative product offerings. This competitive pressure has affected Intel’s ability to leverage its historical leadership position in the semiconductor space.

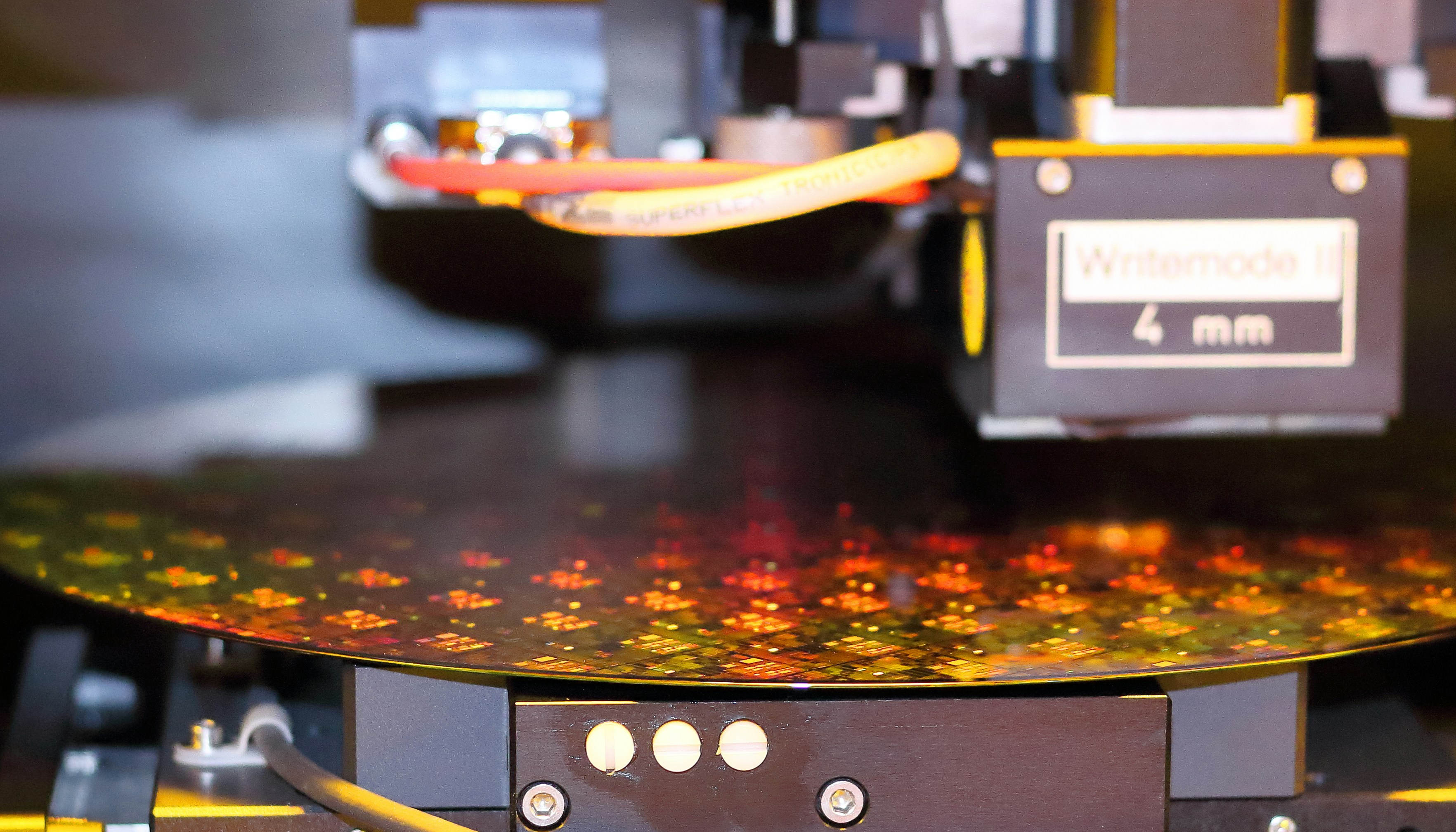

In recent years, Intel has made strategic shifts to regain its footing. The management has emphasized the importance of technological advancements and innovation, focusing heavily on enhancing production capabilities through substantial investments in research and development. This approach aims to foster the creation of advanced semiconductor technologies, ensuring that Intel remains relevant in the face of rapidly evolving customer demands. Moreover, the introduction of new manufacturing processes, including a shift to more efficient 7nm technology, signifies Intel’s commitment to re-establishing its market dominance.

Key performance indicators such as gross margin and earnings per share have shown variability, reflective of both internal adjustments and external market conditions. Additionally, changing consumer behaviors and increasing demand for data centers, driven by the rise of cloud computing and AI solutions, could provide Intel with potential growth avenues. Nevertheless, the company must navigate a complex market landscape shaped by technological advancements and the influx of new competitors. Understanding these factors will be critical in assessing Intel’s market position and predicting its stock price trajectory heading toward 2025.

Key Factors Affecting Intel’s Stock Price in 2025

Several pivotal factors are expected to influence Intel’s stock price by 2025, which can ultimately shape the company’s market position and financial performance. One significant aspect is the forecasted growth in semiconductor demand. As technology continues to evolve, the need for advanced chips in various sectors, including cloud computing, AI applications, and consumer electronics, is expected to rise. Intel, as a leading supplier in the semiconductor industry, stands to benefit from these trends, provided it can enhance production capabilities to meet increasing requirements.

Another critical element affecting Intel’s stock price is supply chain stability. The ongoing disruptions experienced globally, particularly due to pandemic-related challenges, have underscored the vulnerability of semiconductor supply chains. Companies that can navigate these challenges by adopting more resilient supply chain strategies may gain a competitive edge. Intel’s ability to manage its supply chains effectively will be essential in ensuring sufficient product availability while mitigating potential cost pressures arising from component shortages.

Pricing pressures are also on the horizon, owing in part to intense competition from firms like AMD and NVIDIA. These competitors have developed strong products that appeal to consumers and businesses alike. To maintain its market position, Intel may need to adopt competitive pricing strategies, which could impact profit margins and subsequently the stock price. Moreover, regulatory considerations surrounding antitrust and data privacy issues in different regions could add complexity to Intel’s operations, influencing its stock performance depending on how effectively the company addresses these challenges.

Lastly, advancements in technology, especially in artificial intelligence and cloud computing, will be instrumental in shaping Intel’s trajectory moving forward. A robust investment in R&D aimed at harnessing these technologies could result in innovative products vital for penetrating new markets and enhancing profitability. The interplay of these factors will be key indicators in evaluating Intel’s stock price outlook for 2025.

Comparative Analysis with Competitors

As Intel continues to navigate the complexities of the semiconductor industry, understanding its competitive positioning against key rivals such as AMD, NVIDIA, and ARM is critical. Each of these companies presents unique market strategies and product offerings that directly influence Intel’s market share and stock price trajectory. AMD has aggressively pursued innovation with its Ryzen and EPYC processors, which have garnered significant attention and market adoption. Their focus on high-performance computing has enabled them to gain ground on Intel in both consumer and data center segments, thereby affecting investor sentiment and corresponding stock valuations.

NVIDIA, on the other hand, has established itself as a dominant force in graphics processing units (GPUs) and artificial intelligence (AI) technologies. Their strategic investments in AI and cloud computing not only position them at the forefront of emerging tech applications but also create competitive pressure on Intel to bolster its GPU offerings. The introduction of Intel’s Xe series graphics cards highlights their intent to regain influence in a rapidly evolving landscape, but whether this can translate into improved stock performance remains to be seen.

ARM, primarily known for its energy-efficient chip designs, has emerged as a formidable competitor as well. ARM’s architecture is ubiquitous in mobile and embedded systems, creating significant competition for Intel’s traditional x86 architecture. As companies increasingly adopt ARM-based solutions for their energy efficiency, Intel faces challenges in maintaining its market share in various sectors, especially with the rising trend of mobile computing. Overall, these dynamics not only shape the competitive landscape but also influence Intel’s stock price predictions for 2025, making it essential for investors to closely monitor these competitors’ strategies and performance in their decision-making processes.

Analyst Forecasts and Investor Sentiment

The performance of Intel’s stock price leading up to 2025 is under significant scrutiny as analysts and investors assess various market dynamics. A consensus among several financial analysts suggests a cautiously optimistic outlook for Intel, driven by anticipated advancements in semiconductor technology and a potential resurgence in demand. Analysts from leading investment firms project that the stock could see a gradual increase, with price targets varying widely based on expected earnings growth and industry competitiveness. Some forecasts indicate a potential price range between $60 to $80 by the end of 2025, assuming progress in product releases and enhancements in operational efficiency.

Investor sentiment plays a critical role in shaping stock price predictions. Recent trading volumes for Intel have shown fluctuations, reflecting combinations of both enthusiasm and caution among investors. The institutional interest in Intel stock has been particularly pronounced, with several large asset management firms reportedly increasing their positions. This trend indicates a belief in the long-term value of Intel, suggesting that institutional investors view the stock as capturing growth potential amidst a changing technology landscape.

In addition to trading volumes and institutional ownership, sentiment indicators—such as social media trends and investor surveys—paint a mixed picture. While some retail investors express confidence in Intel’s growth trajectory, concerns about competition from other semiconductor companies may temper optimism. Furthermore, potential risks, including supply chain disruptions and geopolitical factors, could impact investor confidence and stock performance, warranting close monitoring. Overall, the convergence of analyst forecasts and prevailing investor sentiment will be crucial in understanding the potential dynamics of Intel’s stock price movements as 2025 approaches.